Grab-Uber Merger: CCCS Imposes Directions on Parties to Restore Market Contestability and Penalties to Deter Anti-Competitive Mergers

24 September 2018

(View Media Release in PDF)

- The Competition and Consumer Commission of Singapore (“CCCS”) has issued an Infringement Decision (“ID”)[1] against Grab[2] and Uber[3] (each a “Party”, and collectively the “Parties”) in relation to the sale of Uber’s Southeast Asian business to Grab for a 27.5% stake in Grab in return (“Transaction”). The Transaction was completed on 26 March 2018. CCCS found that the Transaction has led to a substantial lessening of competition (“SLC”) in the provision of ride-hailing platform services in Singapore.[4]

CCCS’s Interventions

- On 27 March 2018, CCCS commenced an investigation on the basis that the Transaction may have infringed the Competition Act as an anti-competitive merger. CCCS proposed Interim Measures Directions on 30 March 2018 and finalised them on 13 April 2018[5] to lessen the impact of the Transaction on drivers and riders, while continuing with the investigation.

- On 5 July 2018, CCCS completed its investigation and issued a Proposed Infringement Decision (“PID”) against the Parties and invited public feedback on the possible remedies to address the harm to competition resulting from the Transaction. In reaching its final decision, CCCS has carefully considered the written and oral representations from the Parties,[6] feedback from industry players, stakeholders and the public, as well as all available information and evidence.

CCCS’s Findings

Grab increased prices after removal of its closest competitor

- CCCS has examined internal documents of the Parties, and found that Uber would not have left the Singapore market by simply terminating its business if the Transaction had not taken place. Instead, Uber would have continued its operations in Singapore, while exploring other strategic commercial options, such as collaboration with another market player[7], or a sale to an alternative buyer. The Transaction has removed Grab’s closest competitor in ride-hailing platform services, namely Uber.

- CCCS has received numerous complaints from both riders and drivers on the increase in effective fares and commissions by Grab post-Transaction (e.g. via a decrease in the amount and frequency of rider promotions and driver incentives). For example, Grab announced changes to its GrabRewards Scheme in July 2018 which generally reduced the number of points earned by riders per dollar spent on Grab’s trips, and increased the number of points required for redemptions. Indeed, CCCS has found that effective fares[8] have increased between 10% and 15% post-Transaction.

Potential competitors are hampered by exclusivities and cannot scale to compete effectively against Grab

- CCCS finds that Grab currently holds around 80% market share. Despite recent entry by several small players, their market shares remain insignificant. CCCS’s investigation found that strong network effects[9] make it difficult for potential competitors to scale and expand in the market, particularly given that Grab had imposed exclusivity obligations on taxi companies, car rental partners, and some of its drivers. Grab’s exclusivities hamper the ability of potential competitors to access drivers and vehicles that are necessary for expansion in the market.

- CCCS’s assessment is confirmed by feedback from potential new entrants which indicated that without any intervention from CCCS, it would be difficult for them to attain a sufficient network of drivers and riders to provide a satisfactory product and experience to both drivers and riders so as to compete effectively against Grab.

- At the conclusion of its investigation, CCCS has found that the Transaction is anti-competitive, having been carried into effect, and has infringed section 54 of the Competition Act by substantially lessening competition in the ride-hailing platform market in Singapore.

CCCS’s directions

Remedies

- CCCS has issued directions (set out in full in Annex A) to the Parties to lessen the impact of the Transaction on drivers and riders, and to open up the market and level the playing field for new players.[10] These include:

a. Ensuring Grab drivers are free to use any ride-hailing platform and are not required to use Grab exclusively.[11] This will help to increase choices for drivers and riders, and make the market more competitive.

b. Removing Grab’s exclusivity arrangements with any taxi fleet in Singapore so as to increase choices for drivers and riders.

c. Maintaining Grab’s pre-merger pricing algorithm and driver commission rates. This protects riders’ interests against excessive price surges, and drivers’ interests against increases in commissions that they pay to Grab, while not affecting Grab’s flexibility to apply dynamic pricing under normal demand and supply conditions or restricting the amount of rider promotions and driver incentives that Grab wishes to offer.

d. Requiring Uber to sell the vehicles of Lion City Rentals to any potential competitor who makes a reasonable offer based on fair market value, and preventing Uber from selling these vehicles to Grab without CCCS’s prior approval. This prevents Grab and Uber from absorbing or hoarding Lion City Rentals vehicles to inhibit the access to a vehicle fleet by a new competitor.

Financial penalties

-

In addition to the remedies mentioned above, CCCS has imposed financial penalties on Grab and Uber respectively to deter completed, irreversible mergers that harm competition.

-

CCCS had sent a letter to each Party on 9 March 2018 to explain Singapore’s merger notification regime and CCCS’s corresponding powers to investigate and penalise anti-competitive mergers. Under Singapore’s merger notification regime, the Parties had the option to notify the Transaction for CCCS’s clearance prior to its completion. However, the Parties proceeded to complete the Transaction on 26 March 2018 and began the transfer of the acquired assets immediately, thus rendering it practically impossible to restore the status quo (i.e. pre-Transaction). CCCS’s investigations also revealed that the Parties had provided for a mechanism to apportion competition law penalties.

-

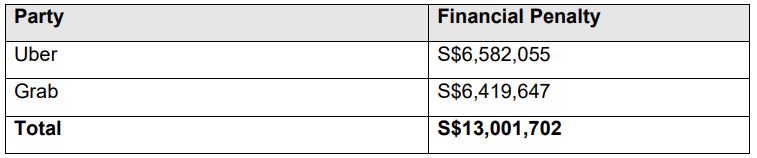

In levying the financial penalties, CCCS has taken into account the relevant turnovers of the Parties, the nature, duration and seriousness of the infringement, aggravating and mitigating factors (such as whether the Parties were cooperative). The financial penalties imposed are as follows:

Further information

-

Mr. Toh Han Li, Chief Executive, CCCS said:

"Mergers that substantially lessen competition are prohibited and CCCS has taken action against the Grab-Uber merger because it removed Grab’s closest rival, to the detriment of Singapore drivers and riders. Companies can continue to innovate in this market, through means other than anti-competitive mergers.”

-

Further information on the investigations, analysis of the case and the basis of calculation of the financial penalties imposed on the Parties are set out in the Infringement Decision, which can be found here: https://www.cccs.gov.sg/public-register-and-consultation/public-register.

-End-

Encl.

Infographic: Grab-Uber Merger

About the Section 54 Prohibition under the Competition Act & Merger Procedures

Section 54 of the Act prohibits mergers that have resulted, or may be expected to result, in a substantial lessening of competition in Singapore.

A merger takes place where:

- Two or more independent business entities merge;

- One or more business entities acquire direct or indirect control of another entity; or

- One entity acquires all or a substantial part of the assets of another entity such that it can replace or substantially replace that entity in the business or in the relevant part of the business.

CCCS is generally of the view that competition concerns are unlikely to arise in a merger situation unless:

- The merged entity has/will have a market share of 40% or more; or

- The merged entity has/will have a market share of between 20% to 40% and the post-merger combined market share of the three largest firms is 70% or more.

Merging entities are not required to notify CCCS of their merger but they should conduct a self-assessment to ascertain if a notification to CCCS is necessary. If they are concerned that the merger has infringed, or is likely to infringe, the Act, they should notify their merger to CCCS. In such cases, CCCS will assess the effect of the merger on competition and decide if the merger has resulted, or is likely to result, in a substantial lessening of competition (“SLC”) in Singapore.

Separately, CCCS has the power to conduct an investigation into an un-notified merger if there are reasonable grounds for suspecting that the merger infringes section 54 of the Act. In the event CCCS finds that a merger situation has resulted or is expected to result in an SLC, CCCS has powers to give directions to remedy the SLC. For example, CCCS can require the merger to be unwound or modified to address or prevent the SLC, as the case may be. CCCS may also consider issuing interim measures prior to the final determination of the investigation.

CCCS also has the power to impose financial penalties where a merger has resulted in SLC and the infringement is committed intentionally or negligently. Financial penalties are calculated based on CCCS’s financial penalty calculation framework; CCCS takes the turnover of each party in the relevant market affected, multiplied by an appropriate starting percentage reflecting the seriousness of the infringement and adjusted for factors such as duration of the proposed infringement, deterrent value, as well as any aggravating and mitigating factors (including whether the Parties has co-operated with CCCS). The quantum of the financial penalty cannot exceed 10% of each Party’s total turnover in Singapore for each year of infringement, up to a maximum of three (3) years.

For more information, please visit www.cccs.gov.sg

ANNEX A

Pursuant to section 69 of the Act (Cap. 50B), CCCS has directed that:

- Grab shall remove all, and shall not impose any, exclusivity obligations, lock-in periods and/or termination fees on all drivers who drive on Grab’s ride-hailing platform (“Grab Drivers”), and shall ensure that Grab Drivers are not penalised, directly or indirectly, as a result of the non-exclusivity.

- The Parties shall remove all, and shall not impose any, exclusivity obligations, exclusive lock-in periods and/or termination fees on all drivers who rent a vehicle from Lion City Rentals, Grab Rentals, and Grab’s rental fleet partners, and shall ensure that these drivers are at liberty to use such vehicles to drive for any ride-hailing platform providing ride-hailing platform services and there shall be no discriminatory terms or any other impediments (e.g. in relation to rental rates and/or insurance coverage) that limit their ability to drive for any rid-hailing platform. Existing Grab Driver Exclusivity Contracts[12] are permitted to remain in place for the remainder of the duration of these agreements, or six (6) months, whichever is shorter, provided that Grab shall not renew the term of these agreements and such drivers are permitted to terminate early the agreements at any time on their own initiative without penalty by Grab for the early termination.

- Grab shall cease any exclusive arrangements with any taxi fleet in Singapore.

- Lion City Rentals (or all or part of its assets) shall not be sold to Grab (directly or indirectly) without CCCS’s approval. Any such purchase from the time of the Transaction to the date of any final decision by CCCS shall be reversed unless otherwise approved expressly by CCCS.

- If any new entrant/existing ride-hailing platform service provider (“Potential Competitor”) makes a reasonable offer based on fair market value[13] to purchase all of Lion City Rentals’ shareholding, or all or part of the assets, Uber must accept the offer unless CCCS raises objection to the potential purchase.

- Grab shall maintain its pre-Transaction pricing, pricing policies and product options (including driver commission rates and structures) in relation to all its products in the ride-hailing platform services market including but not limited to JustGrab; GrabCar; GrabShare; GrabFamily; GrabCar Premium; 6-Seater (Economy); 6-Seater (Premium); Standard Taxi; Standard Taxi (Advanced Booking); Limo Taxi; and Limo Taxi (Advanced Booking). In particular, Grab shall maintain its pre-Transaction algorithm pricing matrix (for those variables that Grab is able to control) for Grab’s ride-hailing platform services which existed on its ride-hailing platform in Singapore prior to the Transaction, which includes that Grab shall not adjust the surge factor and base fares beyond the surge factor cap and base fares at the levels as of 25 March 2018, except for certain pre-defined events. For the avoidance of doubt, this direction does not prevent Grab from introducing new product options, or new pricing or commission structures provided that such product options, and pricing and commission structures do not replace or vary the product options or pricing and commission structures that existed pre-Transaction or render the direction set out in this paragraph substantially ineffective.

- The Parties shall modify the Purchase Agreement to remove any restriction on the acquirers to whom Lion City Rentals could be sold (e.g. sale to a Potential Competitor) and the Parties shall not place any restriction in relation to the use of Lion City Rentals’ vehicles by any Lion City Rentals acquirer.

- The Parties shall appoint a Monitoring Trustee to monitor the Parties’ compliance with CCCS’s directions within 7 days of the issuance of this ID. CCCS shall have the discretion to approve or reject the proposed Monitoring Trustee and to approve the terms and conditions of appointment of the Monitoring Trustee and the audit plan subject to any modifications CCCS deems necessary for the Monitoring Trustee to effectively fulfill its obligations:

- If only one name is approved, the Parties shall appoint or cause to be appointed, the individual or institution as Monitoring Trustee, in accordance with the terms and conditions of appointment approved by CCCS; and

- If more than one name is approved, the Parties shall be free to choose the Monitoring Trustee to be appointed from among the names approved.

- CCCS may at any time vary, substitute or release Grab from one or more of the directions on its own initiative or pursuant to an application by Grab to CCCS supported by reasons and evidence, including but not limited to any circumstances where the direction is no longer necessary or appropriate against the objective of CCCS in preventing the Transaction from resulting in a substantial lessening of competition.

- Without prejudice to the generality of the foregoing, CCCS shall, on its own initiative or pursuant to an application by Grab to CCCS supported by reasons and evidence, suspend all directions on an interim basis (“Interim Suspension”) if an open-platform competitor without any direct or indirect common control with Grab,[14] attains 30% or more of total rides matched in the ride-hailing platform services for 1 calendar month. CCCS shall unconditionally release the Parties from all directions if an open-platform competitor without any direct or indirect common control with Grab, attains 30% or more of total rides matched in the ride-hailing platform services market monthly for 6 consecutive calendar months (“Unconditional Release”). Any action taken by Grab during the period of Interim Suspension should duly take into account the fact that CCCS may reinstate all directions, as long as an Unconditional Release has not been triggered. For the avoidance of doubt, any Interim Suspension or Unconditional Release shall only take effect upon CCCS’s determination of the matter and informing the Parties of the same.

[1] The ID sets out the facts and evidence on which CCCS makes its assessment and its reasons for arriving at the decision.

[2] All references to “Grab” in this media release refer to Grab Inc., and its subsidiaries and any other related entities including but not limited to GrabCar Pte. Ltd., GrabTaxi Holdings Pte. Ltd., GrabTaxi Pte. Ltd., Grab Rentals Pte. Ltd. and Grab Rentals 2 Pte. Ltd.

[3] All references to “Uber” in this media release refer to Uber Technologies, Inc., and its subsidiaries and any other related entities including but not limited to Uber Singapore Technology Pte. Ltd., Lion City Holdings Pte. Ltd., Lion City Rentals Pte. Ltd., Lion City Automobiles Pte. Ltd., and LCRF Pte. Ltd..

[4] A ride-hailing platform enables riders to book chauffeured point-to-point transport services with drivers of taxis or private-hire cars.

[5] The Interim Measures Directions have remained in force until CCCS’s final decision today.

[6] Where CCCS proposes to make an infringement decision, the affected parties are given an opportunity to make written and oral submissions (also known as representations) in relation to the proposed finding of liability and imposition of financial penalty/directions (if any). The affected parties are also given an opportunity to inspect documents relating to the matters referred to in the proposed infringement decision.

[7] Uber had entered into an agreement to collaborate with ComfortDelGro with the introduction of UberFlash to compete with Grab, and the collaboration was only withdrawn after the Transaction, on 25 May 2018.

[8] Trip fares net of rider promotions.

[9] A ride-hailing platform that has built up high levels of usage is more attractive to new drivers and riders than a competitor with less usage whose offerings may otherwise be the same. This indirect network effect reinforces the incumbency of the existing players present in the market, and greatly increases the time and upfront expenditure needed for a new potential entrant to build up a driver network and rider network similar in scale and size to the Parties.

[10] CCCS may at any time vary, substitute or release Grab from one or more of the directions on its own initiative or pursuant to an application by Grab to CCCS if the direction is no longer necessary or appropriate against the objective of CCCS in preventing the Transaction from resulting in a substantial lessening of competition. For example, CCCS considers it would be appropriate to suspend the directions if an open-platform competitor attains 30% or more of total rides matched in the ride-hailing platform services for 1 calendar month, and for the Parties to be released from the directions if such market share is maintained for 6 consecutive months. Further details are set out in Annex A.

[11] Existing exclusive contracts may remain in place for the remaining duration of these agreements, or six (6) months, whichever is shorter, but drivers with existing exclusive contracts can terminate early the agreements at any time on their own initiative without any penalty.

[12] “Existing Grab Driver Exclusivity Contracts” shall be defined as existing contracts that Grab has with CPHC drivers which contain an exclusivity requirement on such drivers to drive exclusively for the Grab ride-hailing platform, excluding any existing contracts which were signed post-Transaction in breach of the IMD.

[13] Fair market value shall be based on the price at which a willing seller would sell, and a willing buyer would buy, such Lion City Rentals’ shares or assets having full knowledge of the relevant facts in an arm’s-length transaction, without either party having time constraints, and without either party being under any compulsion to buy or sell, and taking into account a valuation of the assets or shares by a competent independent valuer and any competing offers or bids from other interested buyers and the terms offered.

[14] CCCS considers that “control” shall mean, with respect to an undertaking, the right to exercise, directly or indirectly, more than 30% of the voting rights of the undertaking; or the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of such undertaking (see paragraph 3.10 of the CCCS Guidelines of the Substantive Assessment of Mergers 2016 Guidelines).