- Home

- Media and Events

- Newsroom

- Announcements and Media Releases

- CCCS Penalises Chinese Yuan Remittance Service Providers $5.36 Million for Illegal Information Exchange

CCCS Penalises Chinese Yuan Remittance Service Providers $5.36 Million for Illegal Information Exchange

31 July 2025

(View media release in PDF)

The Competition and Consumer Commission of Singapore (“CCCS”) has imposed financial penalties exceeding $5.36 million on ZGR Global Pte. Ltd. (formerly known as Zhongguo Remittance Pte. Ltd.) (“ZGR Global”) and Hanshan Money Express Pte. Ltd. (“Hanshan”) (each a “Party”, and collectively, the “Parties”). The Parties, both based in People’s Park Complex, were found to have infringed section 34 of the Competition Act 2004[1], through the illegal exchange of information on each other’s outward remittance rates[2] for the Chinese Yuan (“CNY”) (the “Information Exchange Conduct”).

The Information Exchange Conduct

ZGR Global and Hanshan operate adjacent locations in People’s Park Complex (see Figure 1). They are the two leading providers of CNY remittance services in the building and direct competitors.

The remittance rate offered to customers is a key aspect on which remittance service providers compete. Prior to the Information Exchange Conduct, the Parties closely monitored each other’s CNY remittance rates, including by having their staff pose as customers due to the highly volatile nature of remittance rates. Remittance service providers would update their rates frequently and unpredictably throughout the day.

Figure 1: Proximity of the Parties’ premises in People’s Park Complex (ZGR Global’s premises has the red storefront and Hanshan’s premises has the blue and yellow storefront) (Source: Photo taken by CCCS)

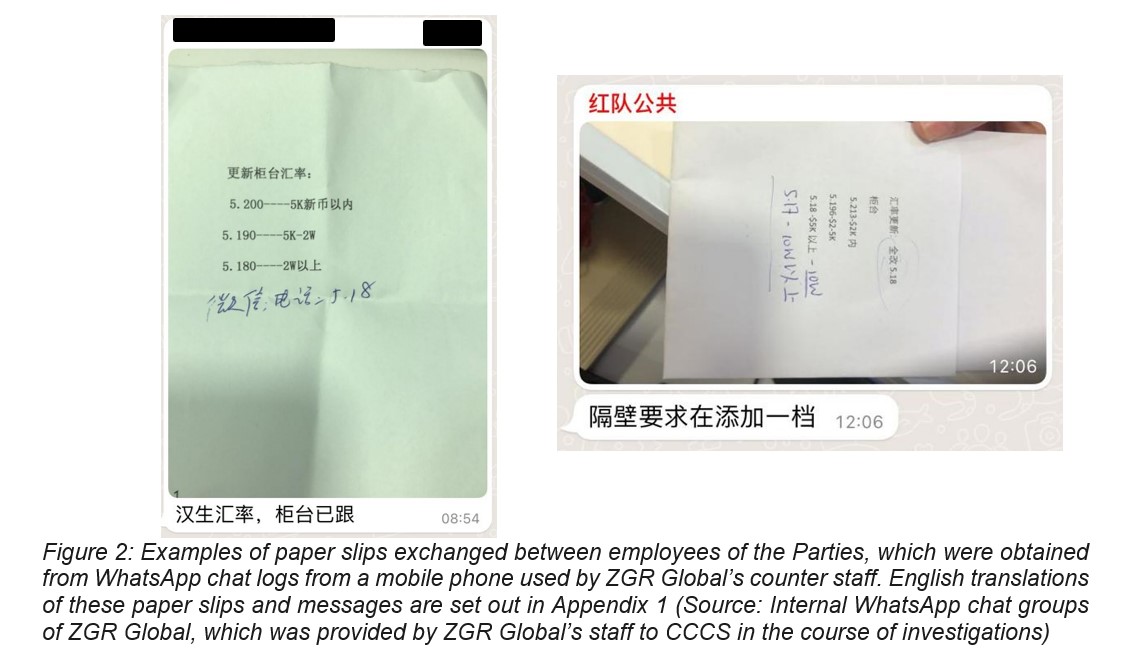

To overcome the uncertainty associated with each other’s remittance rates in an unpredictable environment where rates can change several times daily, the Parties began exchanging information on their prevailing remittance rates, from at least January 2016. The Parties would inform each other of their respective opening rates at the start of their business hours and whenever they decided to update their rates. These exchanges generally occurred daily and often several times each day. CCCS found that employees of the Parties communicated their remittance rates in three ways:[3] (a) verbally over the counter; (b) passing paper slips containing the respective rates (see Figure 2 below); and (c) verbally over the phone.

During investigations, CCCS found that the Parties had exchanged two main types of remittance rate information:

Rates that were published on the Parties’ platform[4] (“Published Rates”). Published Rates were expressed as a single rate and were only indicative as the Parties did not necessarily apply Published Rates to customers’ transactions.

Actual rates applied to customers’ transactions[5] (“Transaction Rates”). Transaction Rates included “tiered rates”, which were rates based on their remittance amount. Examples of “tiered rates” exchanged by the Parties are set out in the paper slips shown in Figure 2 above.

CCCS found that the Parties’ prevailing Transaction Rates, particularly those of “tiered rates”, were not readily available to the public[6]. While the public was not immediately informed of changes in the Parties’ Published Rates and Transaction Rates, the Parties’ Information Exchange Conduct enabled them to instantly access each other’s revised rates. This information was commercially sensitive, as each Party's decisions regarding remittance rates and the timing of updates were influenced by the other party’s rates.

These regular exchanges enabled the Parties to directly receive information from their competitor that influenced the setting of their CNY remittance rates. This undermined the process of competition in the market for CNY remittance services. From the evidence gathered, CCCS observed that the Parties had more similar outward CNY remittance rates when the Information Exchange Conduct took place, thus limiting the variety of rates available for customers.

Although CCCS formally engaged the Parties in July 2021, [7] the Parties only ceased the Information Exchange Conduct in February 2022.[8]

CCCS issued a proposed infringement decision to the Parties on 25 November 2024, and a supplementary infringement decision to the Parties on 11 April 2025.[9] CCCS received written representations from each Party and carefully considered the representations before deciding to issue the infringement decision.

Financial Penalties

In imposing financial penalties, CCCS considered various factors, including each Party’s relevant turnover, the nature and seriousness of the infringement, as well as aggravating and mitigating factors.

CCCS has imposed the following financial penalties on the Parties:

Party | Penalties |

Hanshan Money Express Pte. Ltd. | $2,571,307 |

ZGR Global Pte. Ltd. | $2,793,700 |

Total | $5,365,007 |

An additional discount of 10% was applied to reduce Hanshan’s financial penalties as a result of its admissions to the infringing conduct under the Fast Track Procedure. This was in addition to the discount applied to reflect its cooperation with CCCS’s investigation.[10]

Chief Executive of CCCS, Mr. Alvin Koh said: “A fundamental principle of competition law is that businesses must act independently when determining their conduct in the market. While businesses may observe and adapt to their competitors’ behaviour, they must not communicate with competitors to influence their conduct in the market or share their pricing strategies, for example, sharing information as to ‘when’ they intended to change their quoted rates and the ‘extent’ of changes. By colluding together to exchange such information, the Parties undermined competition in the market for CNY remittance services, which reduced options for customers.”

CCCS advises that businesses asked to participate in anti-competitive information exchanges should (i) immediately decline participation, (ii) publicly distance themselves from such discussions, and (iii) report the matter to CCCS. If you are currently involved in such conduct, CCCS offers a leniency programme[11] with an opportunity for such businesses to come forward with information about anti-competitive agreements and receive a full waiver or substantial reduction in financial penalties. Individuals with information on cartel activity in Singapore can also provide such information through CCCS’s reward/whistle-blowing scheme[12] with monetary rewards of up to $120,000.

Further information on the investigation, analysis of the case and the calculation of financial penalties imposed on the Parties are set out in the Infringement Decision here.

- END -

- Encl. Infographic: Remittance Service Providers Penalised $5.36M for Exchange of Commercially Sensitive Information

About the Competition and Consumer Commission of Singapore

The Competition and Consumer Commission of Singapore (“CCCS”) is a statutory board of the Ministry of Trade and Industry. Our mission is to make markets work well to create opportunities and choices for businesses and consumers in Singapore.

CCCS administers and enforces the Competition Act 2004 and the Consumer Protection (Fair Trading) Act 2003 (“CPFTA”), to guard against anti-competitive activities and unfair trade practices. Additionally, CCCS ensures that businesses observe fair trade measurement practices by administering the Weights and Measures Act 1975, and ensures the supply of safe consumer goods by enforcing and implementing the Consumer Protection (Trade Descriptions and Safety Requirements) Act 1975 and its associated Regulations.

For more information, please visit www.cccs.gov.sg.

Appendix 1 – Translation of Messages in Figure 2

Appendix 2 - CCCS’s Leniency Programme

Appendix 3 - Individuals can get rewards if they report information on cartel activities to CCCS

[1] Section 34 of the Competition Act 2004 prohibits any agreements between undertakings, decisions by associations of undertakings or concerted practices which have as their object or effect the prevention, restriction or distortion of competition within Singapore. An undertaking means any person, being an individual, a body corporate, an unincorporated body of persons or any other entity, capable of carrying on commercial or economic activities relating to goods or services.

[2] Outward remittance rates refer to the amount of foreign currency exchanged and remitted overseas per local currency paid for outward remittance services (i.e. remittance from Singapore to a foreign country). For example, an outward remittance rate of “5.00” for a CNY remittance, means that 5 CNY will be remitted to the target overseas bank account for each Singapore dollar paid to the remittance service provider. The higher the remittance rate, the more money in overseas currency the recipient will receive for the same amount of local currency the sender remits.

[3] These methods of communication were used across different periods of the Information Exchange Conduct.

[4] Examples of platforms where rates were published included the Parties’ websites and automated phone services.

[5] Transaction Rates are determined at the time where a customer complete his/her transaction.

[6] Parties did not display their tiered rates in a prominent manner. The Parties sometimes displayed their tiered rates using a small piece of paper pasted at the Parties’ counters. This was done at the discretion of the Parties’ counter staff. CCCS also found that tiered rates were not published over the Parties’ other platforms.

[7] CCCS engaged the Parties directly following the easing of COVID-19 measures in 2021.

[8] CCCS’s investigation into the Information Exchange Conduct was independently conducted in relation to anti-competitive conduct under the Competition Act 2004, and unrelated to any other investigations by public agencies into the remittance industry.

[9] The proposed infringement decision and supplementary proposed infringement decision are written notices setting out the basis for CCCS’s decision. They are issued to the parties concerned, to give them an opportunity to make representations to CCCS, and provide any other information for consideration, before CCCS finalises its decision on whether there has been an infringement.

[10] Under the Fast Track Procedure, infringing parties admit liability and CCCS achieves procedural efficiencies and resource savings through a streamlined procedure.

[11] More information on CCCS’s leniency programme can be found in Appendix 2.

[12] More information on CCCS’s reward/whistle-blowing scheme can be found in Appendix 3.