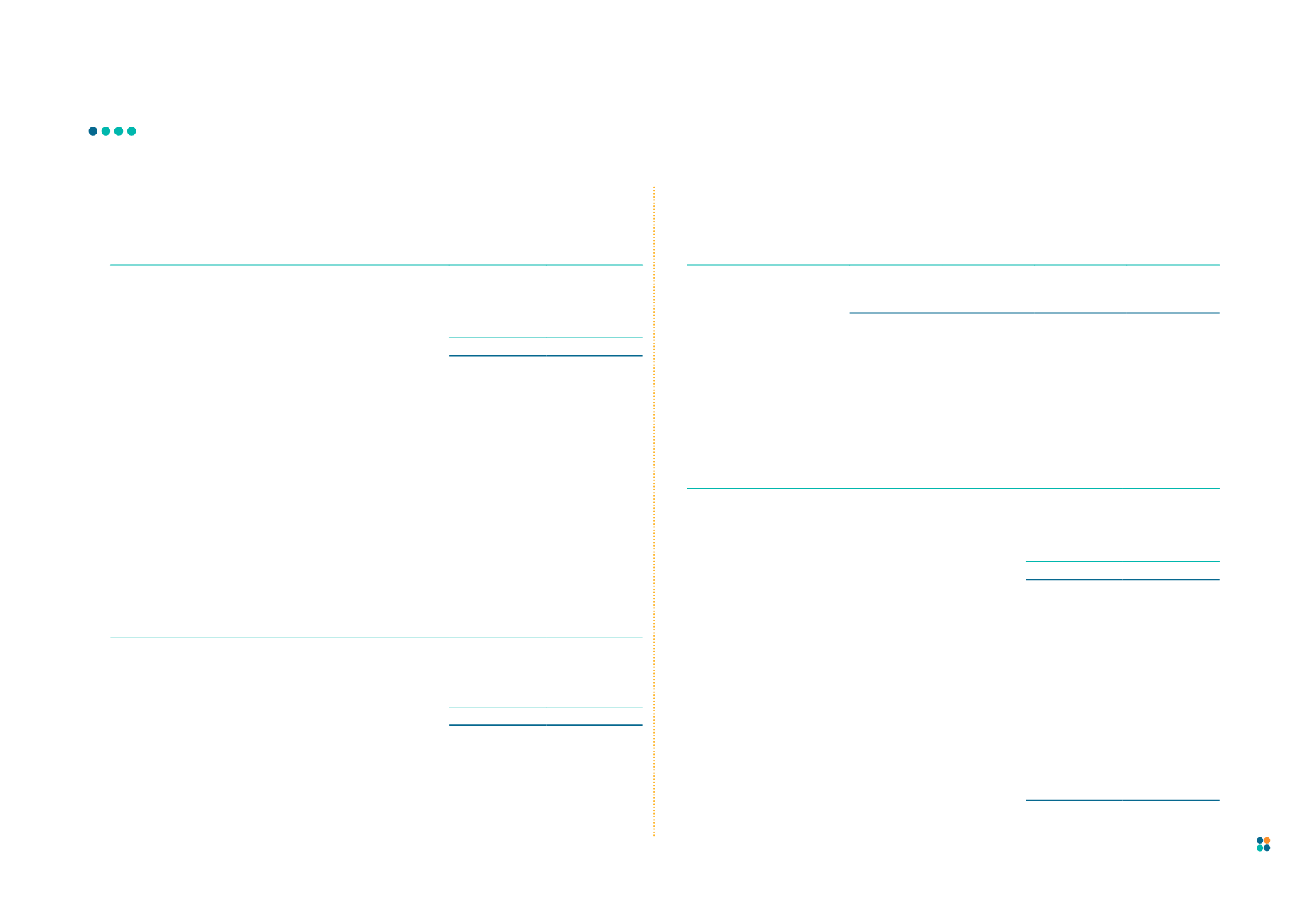

10.

TRADE AND OTHER PAYABLES

2017

2016

$

$

Trade payables

979,264

212,191

Accrued staff costs

878,266

834,000

Accrued operating expenses

731,479

641,938

Deferred income

115,000

105,000

2,704,009

1,793,129

The average credit period is 30 days (2016 : 30 days). No interest is charged on outstanding

balances.

11.

PROVISION FOR CONTRIBUTION TO CONSOLIDATED FUND

The Commission is required to make contributions to the Consolidated Fund in accordance

with the Statutory Corporations (Contributions to Consolidated Fund) Act (Cap 319A, 2004

Revised Edition) and in accordance with the Finance Circular Minute No. 5/2005 with effect

from 2004/2005. The amount to be contributed is based on 17% (2016 : 17%) of the net surplus

of the Commission, after netting off the prior years’ accounting deficit.

12.

DEFERRED CAPITAL GRANTS

2017

2016

$

$

At beginning of financial year

1,024,401

1,227,907

Transfer from operating grants (Note 16)

375,802

104,048

Transfer to statement of profit or loss and other

comprehensive income

(348,896)

(307,554)

At the end of financial year

1,051,307

1,024,401

NOTES TO FINANCIAL STATEMENTS

31 March 2017

13.

SHARE CAPITAL

2017

2016

2017

2016

Number of ordinary shares

$

$

Issued and fully paid up:

Balance at the beginning

and end of financial year

2,097,892

2,097,892

2,097,892

2,097,892

The shares have been fully paid for and are held by the Minister for Finance, a body corporate

incorporated by the Minister for Finance (Incorporation) Act (Chapter 183). The holder of

these shares, which has no par value, is entitled to receive dividends from the Commission.

There is no dividend payable in current year.

14.

REVENUE

2017

2016

$

$

Interest income on cash and bank balances

placed with the Accountant-General's Department

247,645

222,673

Application fee income

488,000

170,000

Other operating income

2,132

71,835

737,777

464,508

15.

SURPLUS (DEFICIT) BEFORE CONTRIBUTION TO CONSOLIDATED FUND

Surplus (Deficit) for the year has been arrived at after charging:

2017

2016

$

$

Operating lease expenses

1,457,558

1,324,556

Salaries, wages and other allowances

9,394,555

9,777,760

Contribution to defined contribution plans, included in

salaries, wages and staff benefits

1,019,322

992,212

ANNUAL REPORT 2016

73