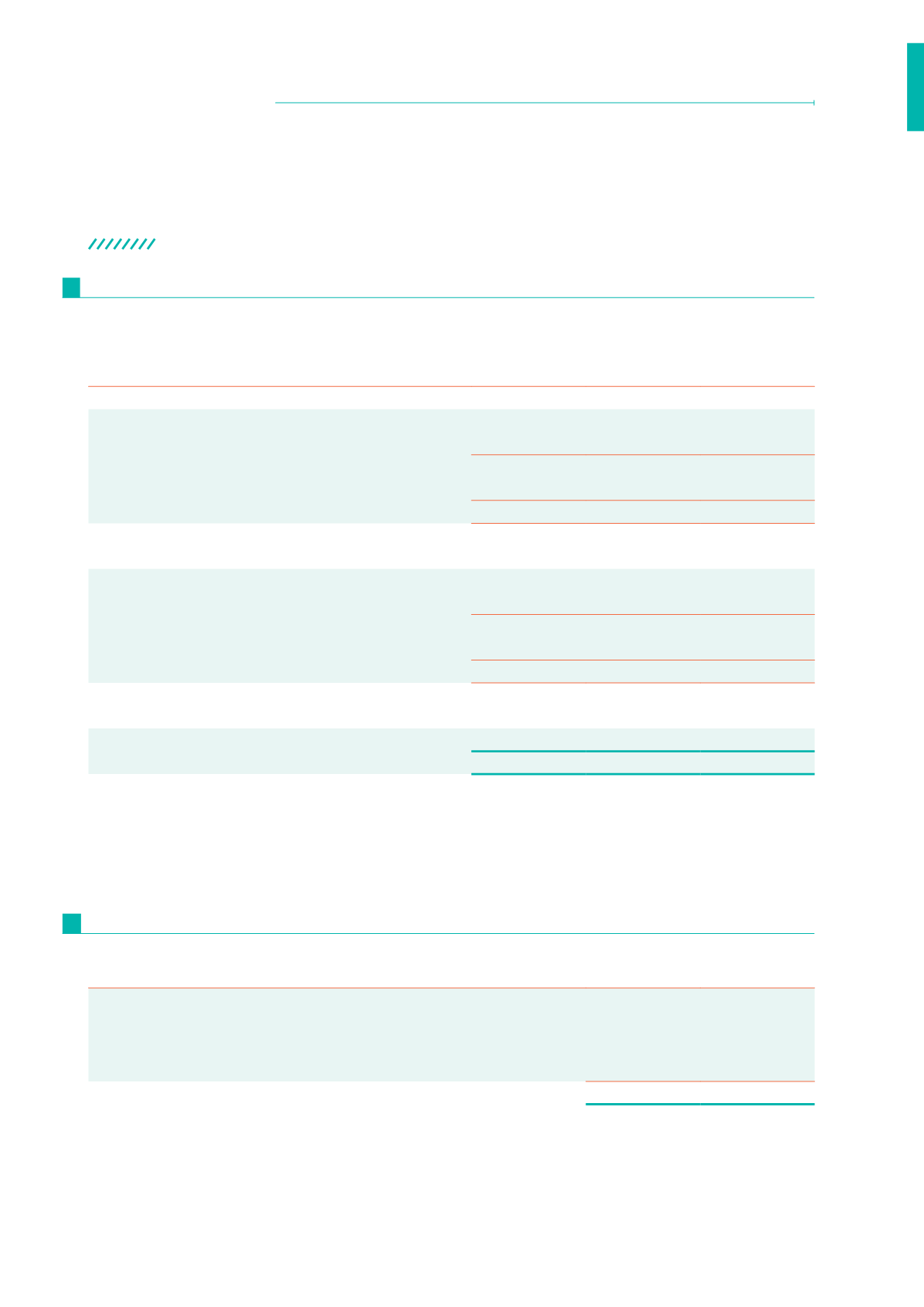

2016

2015

$

$

Trade payables

212,191

Accrued staff costs

834,000

716,000

Accrued operating expenses

641,938

583,376

Deferred income

105,000

55,000

1,793,129

1,354,376

ACQUIRED

COMPUTER

SOFTWARE

DEVELOPMENT

WORK-IN-

PROGRESS

TOTAL

$

$

$

Cost:

At 1 April 2014

450,171

251,750

701,921

Additions

299,829

-

299,829

At 31 March 2015

750,000

251,750

1,001,750

Additions

5,778

-

5,778

At 31 March 2016

755,778

251,750

1,007,528

Amortisation:

At 1 April 2014

184,947

-

184,947

Amortisation

95,393

-

95,393

At 31 March 2015

280,340

-

280,340

Amortisation

133,903

-

133,903

At 31 March 2016

414,243

-

414,243

Carrying amount:

At 31 March 2016

341,535

251,750

593,285

At 31 March 2015

469,660

251,750

721,410

During the financial year, the Commission acquired computer software with aggregate cost of $5,778 (2015

: $299,829). Cash payment of $ 5,778 (2015 : $267,000) were made to purchase computer software and $Nil

(2015 : $32,829) remains unpaid at the end of the reporting period.

Development work-in-progress relates to Knowledge Management System.

The average credit period is 30 days (2015 : 30 days). No interest is charged on outstanding balances.

NOTES TO FINANCIAL STATEMENTS

9

10

INTANGIBLE ASSETS

TRADE AND OTHER PAYABLES

31 MARCH 2016

93

CCS ANNUAL REPORT 2015-2016

FINANCIAL STATEMENTS