15

17

18

16

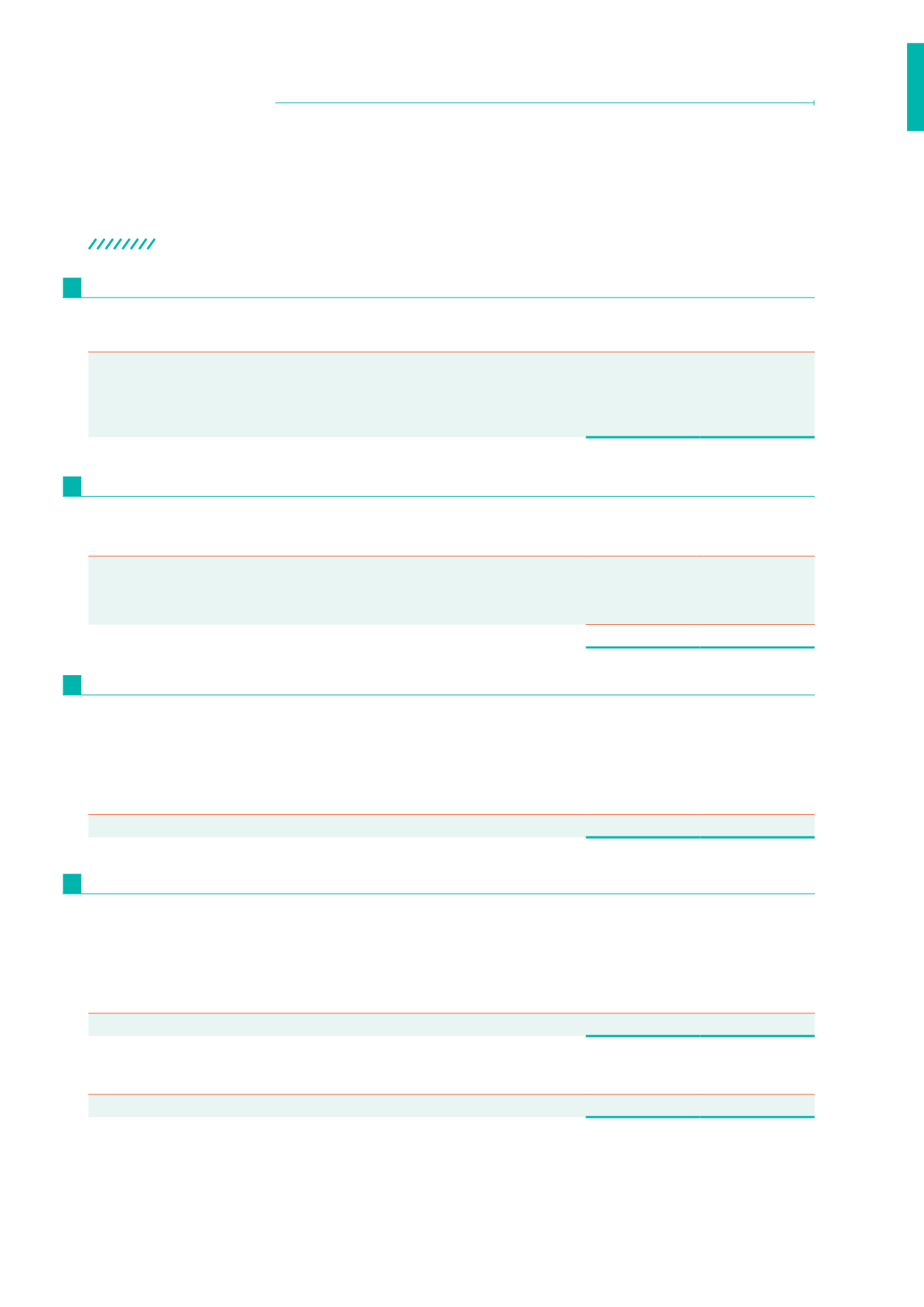

DEFICIT BEFORE CONTRIBUTION TO CONSOLIDATED FUND

FINANCIAL PENALTIES

CAPITAL COMMITMENTS

OPERATING GRANTS

Deficit for the year has been arrived at after charging:

All financial penalties collected by the Commission are paid into the Consolidated Fund in accordance with Section

13(2) of the Competition Act, Chapter 50B. The following financial penalties collected during the financial year are not

included in the financial statements of the Commission.

Minimum lease payments under operating leases recognised as an expense represent rentals payable by the

Commission for its office premises of $1,245,557 (2015 : $1,245,557); office equipment of $15,796 (2015 : $26,322) and

lease of laptops under operating leases of $63,203 (2015 : $44,541).

Capital commitments

Capital expenditure contracted for at the end of the reporting period but not recognised in the financial statements

is as follows:

Operating lease commitments

2016

2015

$

$

Operating lease expenses

1,324,556

1,316,420

Salaries, wages and other allowances

9,777,760

8,654,632

Contribution to defined contribution plans, included in salaries,

wages and staff benefits

992,212

820,719

2016

2015

$

$

Financial penalties collected

4,885,848

9,028,520

2016

2015

$

$

Capital commitments in respect of computer systems

13,250

13,250

2016

2015

$

$

Minimum lease payments under operating leases recognised as an expense

1,324,556

1,316,420

2016

2015

$

$

Grants received from government during the year

15,171,000

14,696,100

Other grants received during the year

160,491

2,300

Transfer to deferred capital grants (Note 12)

(104,048)

(302,911)

15,227,443

14,395,489

NOTES TO FINANCIAL STATEMENTS

31 MARCH 2016

95

CCS ANNUAL REPORT 2015-2016

FINANCIAL STATEMENTS