CCCS Penalises Fresh Chicken Distributors for Price-fixing and Non-compete Agreements

12 September 2018

(View Media Release in PDF)

- The Competition and Consumer Commission of Singapore (“CCCS”) has today issued an Infringement Decision (“ID”)[1] against 13 fresh chicken[2] distributors (“the Parties”)[3] for engaging in anti-competitive agreements[4] to coordinate the amount and timing of price increases, and agreeing not to compete for each other’s customers in the market for the supply of fresh chicken products in Singapore.

The fresh chicken industry

- Fresh chicken distributors import live chickens from farms in Malaysia and slaughter them in Singapore. Thereafter, the distributors sell the fresh chicken products to customers such as supermarkets, restaurants, hotels, wet market stalls and hawker stalls. These products include whole fresh chickens, chicken parts[5] and processed chickens[6].

- Chicken is the most consumed meat in Singapore – more than 30 kg of chicken is consumed per person annually. This is significantly higher than the 1 kg to 20 kg consumed per person annually for other types of meats such as fish, pork, beef and mutton.[7] In 2016, approximately 49 million live chickens were slaughtered in Singapore.[8] The total turnover of the Parties, who collectively supply more than 90% of fresh chicken products in Singapore, amounts to approximately half a billion dollars annually.

CCCS’s investigations

- In March 2014, CCCS commenced its investigations into the fresh chicken distribution industry after it received information from a secret complainant.[9] CCCS’s investigations revealed that, from at least September 2007 to August 2014, the Parties had engaged in discussions on prices and had also expressly coordinated the amount and timing of price increases of certain fresh chicken products[10] sold in Singapore. During these discussions, the Parties had also agreed to not compete for each other’s customers (i.e., market sharing).

- The Parties’ collusion restricted competition in the market and likely contributed to price increases of certain fresh chicken products in Singapore. By agreeing not to compete for each other’s customers, the Parties restricted the choices available to customers. The coordinated price increases further reduced customer choice as it limited options for customers to switch to more competitive distributors.

- In view of the high combined market shares of the Parties, and as chicken is the most commonly consumed meat in Singapore, the Parties’ anti-competitive conduct impacted a large number of customers including supermarkets, restaurants, hotels, wet market stalls and hawker stalls, and ultimately, end-consumers of these fresh chicken products.

- On 8 March 2016, CCCS issued a Proposed Infringement Decision (“PID”) against the Parties. During the course of written and oral representations[11] by the Parties to the PID, further information was provided to CCCS of the Parties’ participation in price discussions and co-ordination of price increases. On 27 September 2016, CCCS notified the Parties that further investigations would be conducted. Subsequently, CCCS received applications by some of the Parties[12] for lenient treatment under CCCS’s leniency programme.[13] On 21 December 2017, CCCS issued a supplementary PID against the Parties and received further written and oral representations. CCCS carefully considered all the representations in reaching its findings.

Financial penalties

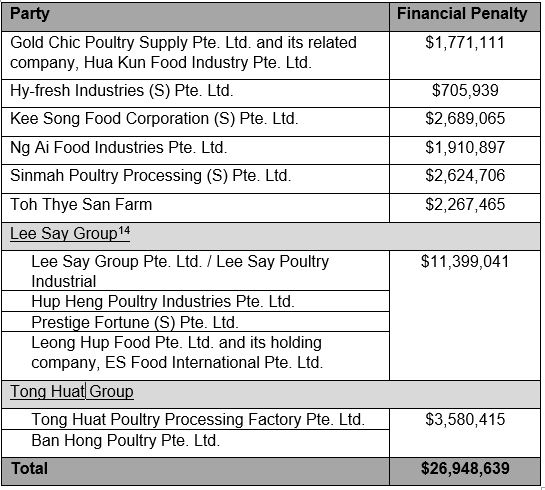

- In levying the financial penalties, CCCS takes into account the relevant turnovers of the Parties, the nature, duration and seriousness of the infringement, aggravating and mitigating factors (such as whether a party had co-operated with CCCS), as well as representations made by the Parties. Particularly for this case, the large size of the industry, the high market shares of the Parties, the seriousness and the long duration (of about seven years) of the cartel conduct contributed to CCCS imposing the highest total financial penalty in a single case to date.

- CCCS has imposed the following financial penalties on the Parties (penalties for entities within the same group are shown as a combined figure):

Other directions

- Aside from financial penalties, CCCS has directed the Parties to provide a written undertaking that they will refrain from using The Poultry Merchants’ Association, Singapore, of which all the Parties are members, or any other industry association as a platform or front, for anti-competitive activities.

- Mr. Toh Han Li, Chief Executive, CCCS said:

"Price-fixing and market sharing are considered some of the most harmful types of anti-competitive conduct. Such conduct is particularly harmful when the products affected are widely consumed in Singapore, such as in this case. CCCS will continue to take strong enforcement action to ensure that cartels do not negatively impact Singapore markets and harm businesses and consumers."

- Further information on the investigations, analysis of the case and the basis of calculation of the financial penalties imposed on the Parties are set out in the Infringement Decision, which can be found here.

- End -

Encl. : Infographic: Fresh Chicken Industry Singapore

________________________________________________________

Appendix 1 – List of Parties:

- Gold Chic Poultry Supply Pte. Ltd.;

- Hua Kun Food Industry Pte. Ltd.;

- Hy-fresh Industries (S) Pte. Ltd.;

- Kee Song Food Corporation (S) Pte. Ltd. (formerly Kee Song Brothers Poultry Industries Pte. Ltd.);

- Lee Say Poultry Industrial and its sole-proprietor, Lee Say Group Pte. Ltd.;

- Hup Heng Poultry Industries Pte. Ltd.;

- Leong Hup Food Pte. Ltd. (formerly KSB Distribution Pte. Ltd.) and its holding company, ES Food International Pte. Ltd.;

- Prestige Fortune (S) Pte. Ltd.;

- Ng Ai Food Industries Pte. Ltd. (formerly Ng Ai Muslim Poultry Industries Pte. Ltd.);

- Sinmah Poultry Processing (S) Pte. Ltd.;

- Toh Thye San Farm;

- Tong Huat Poultry Processing Factory Pte. Ltd.; and

- Ban Hong Poultry Pte. Ltd.

Appendix 2 – CCCS’s Reward Scheme

CCCS is interested in hearing from persons with useful information on cartel activity in Singapore. Persons who are aware of cartel activities and wish to provide the information may write, email or call the CCCS hotline at 1800 3258282 to provide such information. Examples of useful information include:

- Companies/businesses who are part of the cartel;

- Origins of the cartel;

- The nature of the industry where the cartel is operating;

- Documents or other information evidencing the agreements, decisions or practices of the cartel.

CCCS undertakes to keep strictly confidential the identity of secret complainants. In appropriate cases, a monetary reward can be paid to informants for information that leads to infringement decisions against cartel members. Business owners who are involved in cartel activities are not eligible for a reward – they should apply for leniency under CCCS’s leniency programme. For more information, please refer to the CCCS’s website here.

Appendix 3 – CCCS’s Leniency Programme

CCCS’s leniency programme affords lenient treatment to businesses that are part of a cartel agreement or concerted practice (or trade associations that participate in or facilitate cartels), when they come forward to CCCS with information on their cartel activities.

Due to the secret nature of cartels, businesses participating or which have participated in cartel activities are given an incentive to provide CCCS with information and evidence of the cartel’s activities. The policy of granting lenient treatment to these businesses which co-operate with CCCS outweighs the policy objectives of imposing financial penalties on such cartel participants.[15]

Where eligible for lenient treatment, businesses can be granted total immunity or be granted a reduction of up to either 100% or 50% in the level of financial penalties, where applicable. For more information, please refer to the CCCS Guidelines on Lenient Treatment for Undertakings Coming Forward with Information on Cartel Activity 2016 which can be found on CCCS’s website here.

[1] The ID sets out the facts and evidence on which CCCS makes its assessment and its reasons for arriving at the decision.

[2] “Fresh chicken” refers to chickens that are slaughtered in Singapore, as opposed to frozen chickens imported into Singapore.

[3] Please refer to Appendix 1 for a list of the Parties.

[4] Agreements, decisions and concerted practices which prevent, restrict or distort competition are prohibited under section 34 of the Competition Act. Examples of anti-competitive agreements include market sharing and price fixing agreements. Market sharing refers to competitors agreeing to divide/allocate the market by not competing for one another’s customers. Price-fixing involves competitors agreeing to fix, control or maintain the prices of goods or services.

[5] “Chicken parts” refer to fresh chicken products that are distributed in parts e.g. drumsticks, wings, livers.

[6] ‘Processed chickens” refer to fresh chicken products that have been processed, which may include marinating and cooking.

[7] Annual Report 2016/17 of the Agri-Food & Veterinary Authority of Singapore, page 18.

[8] Year Book of Statistics Singapore 2017, Department of Statistics, Ministry of Trade & Industry, Republic of Singapore at section 11.2.

[9] Please refer to Appendix 2 for more information on CCCS’s Reward Scheme for informants with inside information on cartel activities.

[10] These products include whole fresh chickens, whether cut or not, but excluding black chickens, kampong chickens, speciality chickens of the Parties, marinated or cooked chickens and chicken parts.

[11] Where CCCS proposes to make an infringement decision, the affected parties are given an opportunity to make written and oral submissions (also known as representations) in relation to the proposed finding of liability and imposition of financial penalty/directions (if any). The affected parties are also given an opportunity to inspect documents relating to the matters referred to in the proposed infringement decision.

[12] Hy-fresh Industries (S) Pte. Ltd., Kee Song Food Corporation (S) Pte. Ltd., Sinmah Poultry Processing (S) Pte. Ltd., and Tong Huat Poultry Processing Factory Pte. Ltd. and its subsidiary Ban Hong Poultry Pte. Ltd.

[13] Please refer to Appendix 3 for more information on CCCS’s leniency programme.

[14] During the period of the Parties’ anti-competitive conduct, multiple acquisitions took place in the industry and several of the Parties now belong in the same group of companies, including the Lee Say Group and the Tong Huat Group.

[15] Due to the secret nature of cartels, an incentive for cartel participants to come forward to inform CCCS of the cartel’s activities can be a more effective enforcement tool than simply imposing financial penalties.